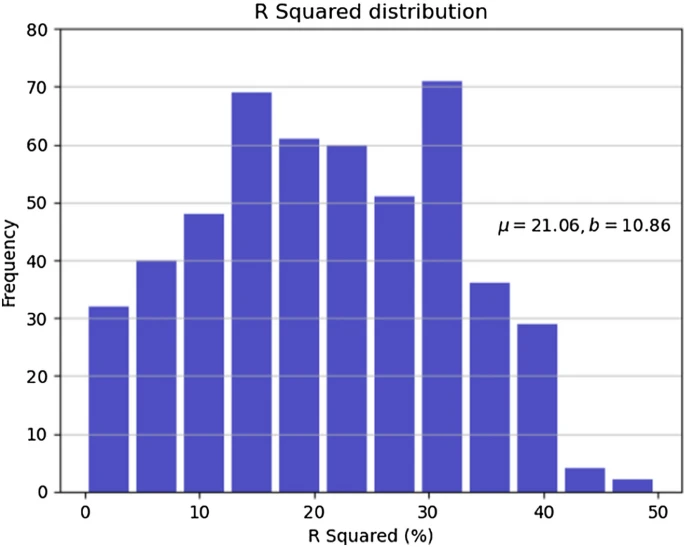

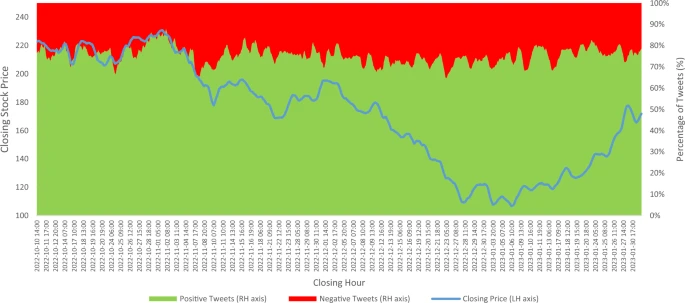

In which the negative factor has an impact nearly 10 times as greater than positive factor. This effect has been present in our two previous studies. Let us recall that we are working with hourly observations in this study and that the volume of tweets is somewhat large at this point.

Discussion

There is still debate in academia regarding how to measure the signal from social networks to stock market performance. In this study, consistent with our two previous works, we have been able once again to measure the impact of negative and positive factor sentiment in stock market for a wide number of companies. Compared to Olson and Nowak (2020), in which the authors measure the negative and positive impact based on negative and positive word count for panel data for the Dow Jones average performance. In this case we have been able to breakdown the effect to each company analyzed and create an individual sentiment factor.

In this study it is presented a methodology to measure the level of overreaction to negative news through the Negative sentiment Factor and that the signal travels as fast as an hour. The econometric model used is around GARCH family showing the asymmetric impact of news on the returns of stock prices. These effects have been recognized to exist showing that negative news tend to have a greater impact on the dependent variable than positive news. For the case of the firms reported in our paper, this stylized fact is found in the modeling of the variable of sentiment divided into positive and negative mood related to the prices (returns) of the stocks.

The present study is useful for the investors and regulators given the insights for the impact on portfolios which involve stocks and want to investigate for possible sources of returns and risk in the financial markets. As limitation here we used a member of the GARCH family. However, other models are more general like Markov switching GARCH, i.e., change of regime models to study the changes in the dynamic of princes/returns.

Conclusion

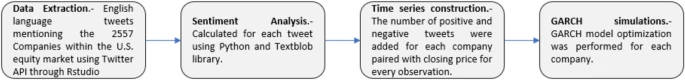

In this paper we have gone through the full framework that we have developed. To clarify, having coded the full process, it was a matter of automatizing the routines to have the extraction, transformation, analysis, and summarization on a constant basis without major intervention.

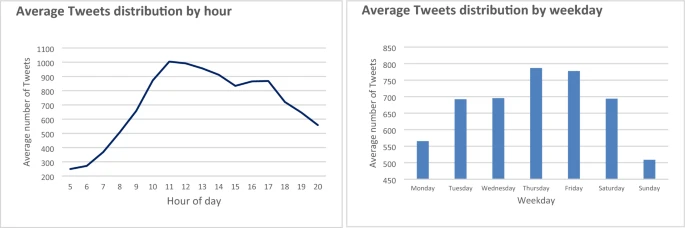

Starting from the premise that there exists influence of the social networks in the stock markets, the natural next step would be to measure negative and positive impact aiming to capture the asymmetric effect. This research concludes that there is influence from the social network into the stock market and reaffirms our proposed factor calculation methodology in a previous work (Mendoza et al. 2022, 2021), the data sampling from top tweets to all available was increased and the stock companies from 24 to 2,557. Additionally, the frequency was increased from daily to hourly observations.

Another remark is that even when the volume of positive comments is on average 4 times as larger as the volume of negative comments, the impact of negative comments is as greater as 10 times than the positive comments. Additionally, if there exists persistence of negative comments, the affectation in the stock price keeps constant. Meaning that a single volume of very negative comments won’t hurt a company price more than a constant not so negative flow of comments over a longer period of time.

Finally, we conclude with the success rate increase from 83% to 93% versus our previous work, meaning that for 503 of the 539 companies, it was possible to capture the asymmetric effect of negative and positive factor. At last, but not least, the speed at which the sentiment travels from the social network toward the stock market can be measured in under an hour.

Limitations of this work are the complication to extract and structure the enormous amount of information in time to make managerial decisions. Additionally, the access to the data given the acknowledgement of its importance by the managers of social media has been restricted over the last years. Policy implications are multiple, starting from including the analysis of a company popularity to make informed decisions, as to how can managers of the companies being mentioned in social media control their image to the general population. Future studies can focus in optimizing the sentiment and text trends extraction to capture further hidden data important for decision makers. Additionally, optimizing the data processing allowing managers to make decisions faster with more accurate information.